Advertisement

Advertisement

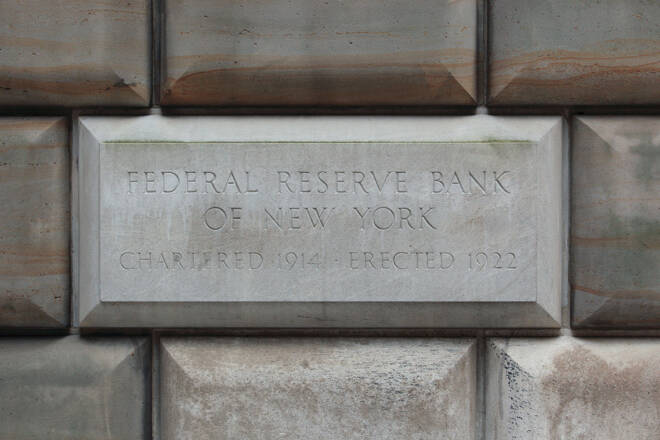

Fed’s Williams Sees Fed Funds Rate Peaking at 5%-5.25%

By:

Williams said that the labor market is still very strong and that the central bank still has more work to do on interest rates.

New York Federal Reserve Bank of New York President John Williams said on Wednesday that the labor market is still very strong and that the central bank still has more work to do on interest rates, according to Reuters.

“The Fed will watch the data to determine the path of rate rises,” Williams added and argued that inflation could prove more persistent. “Maybe services prices stay elevated, and if that happens we’ll need higher rates.”

Williams also added that there is a lot of uncertainty around the inflation outlook. Additionally, some underlying inflation numbers like Dallas Fed trimmed mean is around 3.75% and Fed funds is about 1 percentage point above that. To get sufficiently restrictive, you need to get higher than that. He also added that he broadly sees financial conditions as having moved tighter.

Williams also said that a peak rate of 5%-5.25% is still a reasonable view.

Williams’ Message Barely Wavers from January Comments

In mid-January, Federal Reserve Bank of New York President John Williams said on Thursday the U.S. central bank has more rate hikes ahead and sees signs of inflationary pressures might be starting to cool off from torrid levels.

“With inflation still high and indications of continued supply-demand imbalances, it is clear that monetary policy still has more work to do to bring inflation down to our 2% goal on a sustained basis,” Williams said in the text of a speech to be delivered before the Fixed Income Analysts Society in New York.

“Bringing inflation down is likely to require a period of below-trend growth and some softening of labor market conditions,” Williams warned. He added that “restoring price stability is essential to achieving maximum employment and stable prices over the longer-term, and it is critical that we stay the course until the job is done.”

For a look at all of today’s economic events, check out our economic calendar.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement