Advertisement

Advertisement

Grains Jump on Planting Delays, Short-Covering

By:

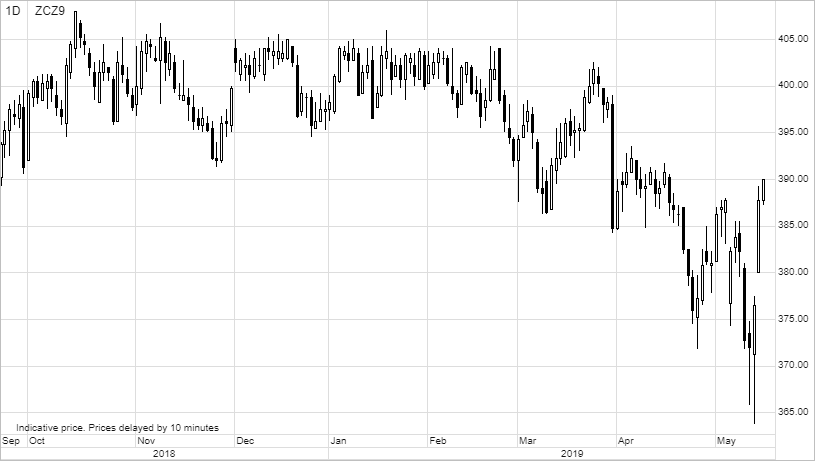

Grain prices are on the rise with corn leading the charge. The rally represents a rebound from Monday's trade war lows, with prices rising due to planting delays and short-covering.

Grains, led by corn, have found a bid after hitting a trade war-related low on Monday. President Trump talking up the prospect of a trade deal in June, following the latest failure and together with a very slow planting progress in the US, have triggered what was a long overdue bout of short-covering from funds holding a record short across the sector.

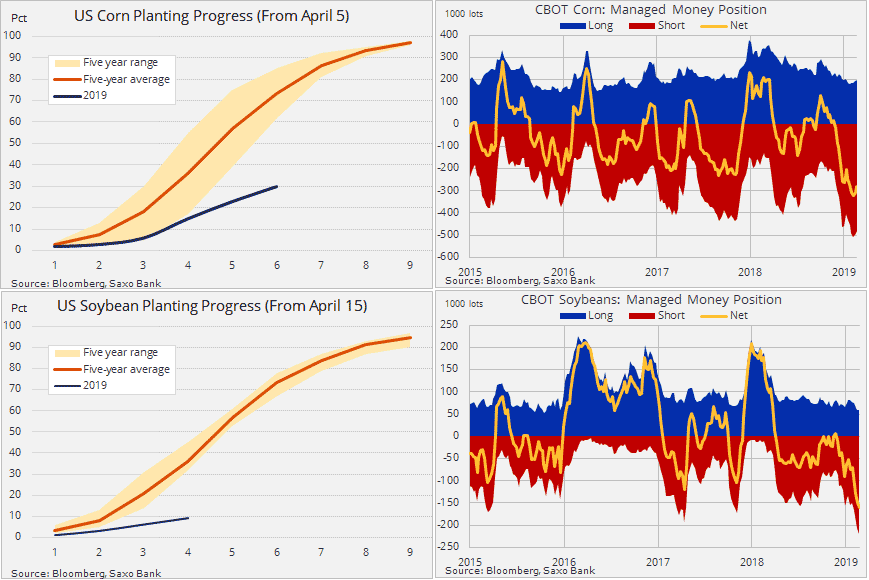

During the spring planting period, the US Department of Agriculture provides the market with a progress report every Monday at 20:00 GMT. The latest report highlights the impact of the US midwest having been inundated with rain for weeks. Many fields have been left flooded, preventing US farmers from making meaningful progress.

Only 30% of the corn crop has been planted. That is the slowest pace since 2013 and trails the five-year average by 66%. Soybean planting is off to the worst start in six years but a change towards drier conditions could trigger a rapid pick-up in the planting speed.

Corn is the crop currently being impacted the most and with the planting window being open for just another few weeks, the risk is rising that the expected corn acreage will be smaller than expected. Soybeans, meanwhile, have been hit by a perfect storm of price-negative news related to demand.

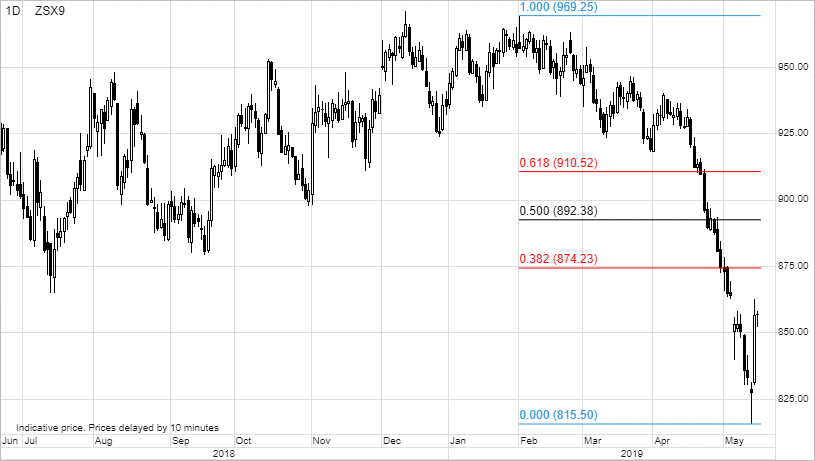

The trade war has resulted in a slump in demand from China and that demand may struggle to recover as the African Swine Fewer epidemic in China is likely to trigger a dramatic reduction of the herd. Adding insult to injury, a delay in corn planting could see farmers switch to later-planted soybeans. This apart from periods of technical short-covering should leave the bean struggle to put in a meaningful recovery.

CBOT Corn, December 2019 is targeting the old consolidation area between $3.95 and $4.05/bushel.

CBOT Soybeans, which tumbled to a decade low on Monday is likely to continue to struggle amid the risk of rising supply from acreage switch and reduced demand. The first formidable challenge likely to be $8.74/bu, the 38.2% correction of the February to May sell-off.

This article is provided by Saxo Capital Markets (Australia) Pty. Ltd, part of Saxo Bank Group through RSS feeds on FX Empire.

About the Author

Ole Hansencontributor

Ole Hansen joined Saxo Bank in 2008 and has been Head of Commodity Strategy since 2010.

Advertisement